By Mark Leybourne, Senior Energy Specialist – Offshore Wind at The World Bank

Just 1% of the world’s offshore wind resource could provide 10% of our electricity demand. Currently, we are only benefitting from a tiny fraction of that potential, but this is quickly changing. By 2030, it’s expected that over 230 GW of offshore wind will be operating globally; a seven-fold increase from the 32 GW today. New, emerging markets will contribute to this increasing capacity and offshore wind can play a significant role in their future economic growth. The World Bank Group’s (WBG) Offshore Wind Development Program was established to accelerate progress in developing economies and, in the run up to COP26, we are encouraging governments in emerging markets to commit to offshore wind and include it in their mid to long term energy strategies.

Introduction & Key Findings

Our first work under the WBG Offshore Wind Development Program was to investigate the offshore wind opportunity in key emerging markets; the Going Global report published in late 2019 focused on 8 of those countries and highlighted over 3 TW of technical potential. We continued to develop our analysis on the global offshore wind opportunity and, in 2020, published a series of maps and resource estimates for 56 countries and regions.

Our latest work on this topic has taken a step further to look at the whole world and has found;

1. The global technical potential for offshore wind is over 71 TW.

2. Over 70% of the technical potential is in deeper waters suited to floating wind.

3. 10% of the identified global resource could generate more electricity than the world currently demands.

4. The offshore wind technical potential in World Bank Group client countries is over 16 TW

Global Technical Potential of Offshore Wind

We identified 115 countries with technically extractable offshore wind resources and, for each country, estimated the total technical potential for fixed and floating wind technologies. We estimate the total global technical potential of offshore wind as 71 TW; 29% of which is found in fixed offshore wind conditions and at least double that ( approximately 71%) is in deeper water, suited to floating wind.

In 2018, the world generated 26,730 TWh of electricity. Exploiting just 1% of the total global offshore wind technical potential could meet at least 10% of the world’s electricity supply [assuming an average net capacity factor of 45% across the 1% of resource would generate over 2,800 TWh/yr]. The IEA’s estimate is even more optimistic, with the potential for offshore wind to generate more than 420,000 TWh per year – more than 18 times global electricity demand today. Regardless of the assumptions made, it is clear that the potential for offshore wind is vast and, as the world’s electricity demand is growing rapidly, offshore wind is a resource that should be considered by any country with resource potential.

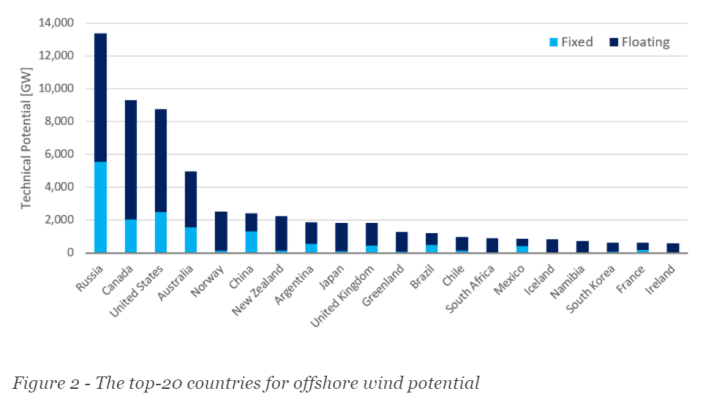

Over 80% of the global technical potential is attributed to only 20 countries. However, only 8 of these 20 markets have any offshore wind capacity currently operating, and only 2 of these (UK and China) currently have utility scale projects.

Industry Vision to 2050

These figures highlight the magnitude of the vast, underutilised energy potential in our waters. Offshore wind is starting to feature in the energy policies of an increasing number of countries as it is widely accepted that this technology will play an important role in the energy transition and meeting the targets set in the Paris Agreement. But with only 32 GW operational worldwide, we have a long way to go.

During this decade, offshore wind deployment rates will accelerate in order to deliver ambitious 2030 targets that have been set, for example; the UK (40 GW), EU (80 GW) and the USA (over 30 GW), China (60 GW) and Taiwan (over 10 GW). The Global Wind Energy Council (GWEC) predicts that at least 234 GW of offshore wind will be operational across the globe by 2030. GWEC also notes that governments around the world view offshore wind as a potential major contributor to post-COVID economic recovery and green growth.

Looking further to the future, in response to the findings from the UN HLP Ocean Panel, the Ocean Renewable Energy Action Coalition (OREAC) published a vision that would see 1,400 GW of offshore wind operating across the globe by 2050 (I encourage you to read OREAC’s findings and understand the role of offshore wind can have in reducing global emissions).

To achieve this vision, we will need to see continued acceleration of installations in established markets and the creation and growth of new markets, particularly across Latin America, Africa and Asia. Given the long lead time of offshore wind market and project development, commitments and targets are needed now (as we have recently seen in the UK, EU and USA) to set policy direction and provide positive signals to mobilise this industry.

With COP26 only months away and updated NDC pledges due, the time is now for offshore wind.

The Role of Emerging Markets

At least 16 TW of the total global potential is within the waters of low and middle income countries – the clients of World Bank Group. Many of these countries (such as South Africa, Vietnam and India) rely on coal generation and often plan new coal plants to help meet their future energy needs. Offshore wind’s high capacity factor and proximity to load centres mean that it is ideal to displace coal generation. The IEA estimates that, when displacing coal, offshore wind can avoid the most direct CO2 emissions in comparison with other renewable generation; equivalent to 3.5 million tonnes of CO2 per year for each GW of offshore wind installed.

We are currently supporting 7 governments to assess their offshore wind resources and develop plans to establish offshore wind in their countries’ waters. The following chart shows 10 of our target emerging markets for offshore wind, based on the resource potential, government engagement, and local drivers for offshore wind. Whilst all of these markets have some fixed offshore wind potential, the floating wind potential is often substantially greater.

To understand how offshore wind compares within the context of local electricity demands, I have made an assumption that each country could exploit 5% of its total resource potential available and compared the estimated offshore wind generation with the annual consumption of electricity. The following chart shows that for most of these markets, at least 25% of current electricity demand could be met by offshore wind and, in some cases, the generation potential exceeds the demand. Although the resource potential in India and Turkey is large, their energy demands are also large (and growing), hence offshore wind will have a smaller, relative contribution but still can be important in their future low-carbon energy mix.

The future evolution of our energy systems is likely to mean greater regional grid interconnection and markets for green hydrogen. Offshore wind, deployed cheaply at large scale, could therefore allow countries to become net exporters of energy.

SIDS – Small Island Developing States

My final reflection on the findings from our analysis relates to SIDS. The waters around SIDS usually have an area many times greater than the island’s land area. There is often limited land available for onshore renewable generation and a reliance on imported, carbon intensive fuels for generation. Consequently, electricity prices are high, as are the resulting emissions.

Offshore wind could help some islands decarbonise, reduce energy costs and help provide energy independence. For example, harvesting 5% of Fiji’s offshore wind technical potential would generate 32 times more electricity than the island currently consumes annually.

An abundant supply of energy at a lower cost could open huge new development opportunities for SIDS and diversify their economies (many have suffered during COVID as result of their reliance on tourism related revenues). Furthermore, with the commercialisation of green hydrogen production and the creation of hydrogen markets, islands could one day become energy exporters. The scale of offshore wind generation in SIDS is likely to be small and so, these islands will need development assistance from organisation such as WBG. We hope to start work with some of these islands in the coming year.

The article has been sourced from the author’s Linkedin post and can be accessed by clicking here