Historically, times of macroeconomic downturns have been associated with a deceleration of global decarbonisation efforts, as affordability has taken precedence over sustainability. However, the current (covid-19) situation is different, especially for technologies that are now mature enough to be deployed at scale and can benefit from a falling cost of capital and an attractive regulatory framework. These can actually unlock one of the largest infrastructure investment opportunities in history. According to Goldman Sachs, clean technology has a major role to play in the economic recovery post covid-19. It is estimated that clean technology has the potential to drive $1-2 trillion per annum of green infrastructure investments and create 15-20 million jobs worldwide, through public-private collaboration. In fact, renewable power is set to become the largest area of spending in the energy industry in 2021, surpassing upstream oil and gas for the first time in history. In its recent report, “Carbonomics: The green engine of economic recovery”, Goldman Sachs addresses the potential impact of the covid-19 outbreak on the pace of the global decarbonisation efforts and the role that clean technologies can play in the upcoming economic recovery. Following is a brief summary of the report.

A $1-2 trillion per annum opportunity

The cost curve of decarbonisation is steep and is likely to require substantial technological innovation. The low-cost end of the curve is primarily associated with power generation and building efficiency. These together have the triple advantage of generating local jobs, benefiting from low cost of capital and successful public-private partnerships along with limited cost to the national budgets. Whilst the growth in investment in clean energies moderated during previous economic downturns, the much more abrupt fall in investments in other parts of the energy system (particularly upstream oil and gas) resulted in a hike in clean energy investments. The overall share of clean energies (renewables including bioenergy) in the total energy supply capex is estimated to increase from 15 per cent in 2014 to 25 per cent by 2021, making capex in renewable power supply larger than capex in upstream oil and gas for the first time in history by 2021.

The key technologies required to decarbonise the energy value chain include an increasing uptake of renewables and biofuels, with a greater focus on greater focus on natural sinks, clean hydrogen and carbon sequestration with carbon-dioxide capture and storage. In aggregate, a total investment opportunity of up to $16 trillion is estimated by 2030 in a scenario that would be consistent with the global ambition to contain global warming within 2°C. This is estimated on the basis of the accelerated uptake of renewables, the electric vehicle and power networks infrastructure required to facilitate an increasingly electrified transport system, and carbon sequestration likely to be required.

This $16 trillion investment opportunity could be fully funded by private capital, provided there is a constructive regulatory framework globally. The cost of capital for new clean energy projects continues on a downward trajectory, improving the affordability and competitiveness of clean energy. On the contrary, financial conditions keep tightening for long-term hydrocarbon developments, creating higher barriers to entry, lower activity, and ultimately lower oil and gas supply.

Carbonomics and job creation

Economic policy following a recession is often driven by the desire to increase employment within the constraints of limited financial resources. Green infrastructure could play a major role in this economic recovery, as it tends to be more capital and job intensive than traditional energy developments. It also benefits from a much lower cost of capital under the right regulatory framework, making it a strong example of a successful pro-growth pro-environment public-private partnership. Across both power generation and transport, clean technologies have a notably higher capital intensity than hydrocarbons. With greater capital intensity comes the greater need for low cost of capital and revenue visibility. Furthermore, the low-carbon economy’s higher capital intensity is likely to foster employment creation, as indicated by the strong correlation between the capital intensity per unit of energy and its labour intensity. In fact, solar PV is, according to the International Labour Organization and the International Renewable Energy Agency, the most labour intensive clean technology in power generation.

Thus, an acceleration of the energy transition towards the goals laid out in the Paris Agreement could lead to net job creation of 15-20 million jobs globally by 2030. The majority of the employment creation would be from the renewables space dominated by construction and manufacturing and from the infrastructure required for the electrification of transport.

Carbonomics and past recessions

Previous recessions have shown carbon pricing to be cyclical, with concerns of affordability and manufacturing cost competitiveness becoming particularly strong in the aftermath of a recession. Carbon pricing will be a critical part of any effort to move to net zero emissions, while incentivising technological innovation and wider adoption and progress of decarbonisation. At present, 61 carbon pricing initiatives are underway, covering 46 national and 32 regional jurisdictions worldwide. These initiatives had gained significant momentum over the past several years, yet the current pace of implementation is currently at risk given the covid-19 outbreak and the harsh economic dynamics that have resulted.

In the previous financial crisis of 2008-09, European carbon prices collapsed, as a direct result of deteriorating demand and non-adjusted supply. Since 2017, a material impact has been seen on the CO2 prices. This is on account of the EU introducing enhancements to the scheme that pushed down the total surplus in circulation to a level where prices needed to move up to balance the system overall. Nonetheless, similar to the previous financial crisis, since the outbreak of covid-19, weaker demand, higher renewable build, lower fuel switching costs and the scope for excess allowances given to industry to be sold on to the market have contributed to a notable fall in carbon prices. Having noted that, the current fall in carbon prices is of a lesser scale than the previous financial downturn. This is owing partly to the current EU credit supply mechanism that acts as a protection to a similar collapse, but also the increased customer awareness and the rising importance of the voluntary carbon credit market which remains active. In the previous financial crisis, low-cost technologies such as renewable power were significantly less affected and returned to growth, compared to other higher-cost technologies such as biofuels and carbon capture, which did not recover for many years. This pattern may repeat itself with the emergence of a two-speed decarbonisation process that presents a material risk to technological innovation on the higher-cost end of the decarbonisation cost curve.

The importance of technological innovation

Despite the wealth of relatively low-cost decarbonisation opportunities, the abatement cost curve is steep beyond 50 per cent decarbonisation. The recovery that is likely to follow the covid-19 crisis should result in the acceleration of low-cost opportunities for decarbonisation, which are primarily focused on the shift of power generation from more carbon-intense fuels to the cleaner renewables and natural gas and increased penetration of LNG in shipping. In fact, such areas of investment could act as a further catalyst for increased employment. However, as the governments turn their focus to fiscal budgets, the re-start of the economy and increased employment, additional incentives that focus on the higher-cost emerging decarbonisation technologies are likely to become scarcer. This will result in a deceleration of the development, scale-up and broader adoption of higher-cost technologies, whose deployment is likely to be delayed. Amongst these are the electrification of transport, biofuels, industrial decarbonisation and hydrogen.

In addition to conservation technologies, sequestration is another critical piece of the puzzle. Even if all current available technologies were put to action, 25 per cent of global GHG emissions would remain non-abatable under current technologies. This further highlights the importance of sequestration which can be broadly classified into three categories, natural sinks, carbon capture, utilisation and storage technologies (CCUS) and direct air carbon capture (DACCS). Similar to conservation technologies, the recovery from covid-19 is likely to accelerate the decarbonisation efforts of the low-cost sequestration routes, primarily natural sinks. However, deceleration will happen in the pace of investments and focus on more costly technologies that have not yet experienced the cost benefits of wider adoption and economies of scale, such as DACCS.

The rise of green shareholder proposals

With global GHG emissions on a persisting upwards trajectory over the past few years, investors have emerged with a leading role in driving the climate change debate. They have pushed corporate managements towards incorporating climate change into their business plans and strategies. The number of climate-related shareholder proposals has almost doubled since 2011 and the percentage of investors voting in favour has tripled over the same time period. The year 2020 has been, so far, despite the outbreak of covid-19, another year of strong shareholder engagement on climate change. The year-to-date climate-related shareholder resolutions have exceeded last year’s on an annualised basis, with the most notable increase coming from Europe. Similarly, the percentage vote in favour has increased year-on-year, exceeding by 30 per cent. This investor pressure, however, is not uniformly distributed across sectors. It shows a clear bias towards energy producers vs. energy consumers, with data since 2014 showing 50 per cent of proposals targeting energy producers (oil and gas, utilities, coal) while only 30 per cent for the sectors that account for most of the final energy consumption. The estimated 2020 data show even higher engagement, with almost 40 per cent of all climate change-related shareholder resolutions targeting oil and gas companies in all regions.

The end of non-OPEC growth

The current macro commodity downturn is likely to result in oil and gas market tightness from 2021 onwards, which is in line with higher commodity prices in the “Age of Climate Change”. This should be consistent with a gradual reduction in consumption of the fuels longer term and could gradually encourage the transition of consumer behaviour, in line with what is required for net zero longer term. However, in the near term it creates a more profitable structure for the oil and gas industry, through consolidation, higher barriers to entry and higher hurdle rates for incremental oil and gas investments.

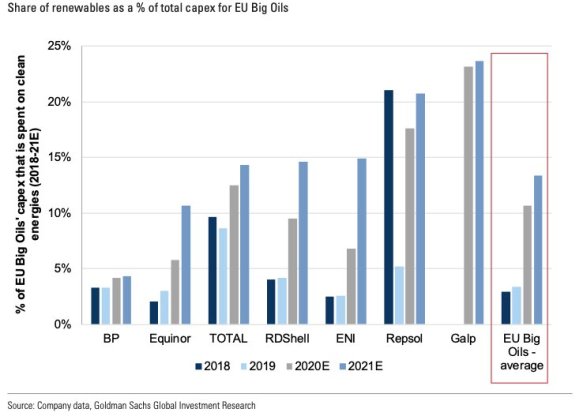

Even so, big oil corporates have shown a significant ability to adapt to technological change in their 100+ years of history. It is now strategic that they drive a low-carbon transition consistent with the global ambition to contain global warming within 2°C. These companies have many tools to achieve this transition and become broader, cleaner energy providers including a deeper presence in the global gas and power chains, including retail, EV charging and renewables; biofuels; petrochemicals; improved upstream and industrial operations; and carbon capture. This transition will require deep cultural and corporate changes and may leave the higher-carbon parts of the value chain financially stranded and under-invested. Overall, European big oil corporates are already spending 50 per cent of their capex on the low-carbon transition. Moreover, the current macro commodity downturn has resulted in a strong capital discipline response from the oil majors, whilst the absolute amount spent on low-carbon energy remains intact. Against this backdrop, the share of low carbon energy as a percentage of total capex for the oil majors is estimated to increase from 2-5 per cent in 2018-19 to 10-15 per cent on average in 2020-21.

The full report can be accessed by clicking on “Carbonomics: The green engine of economic recovery”