The first half of the year 2020 witnessed the virtual halting of economies across the world as covid-19 spread to all corners of the globe. The rapid rise in infections and ensuing lockdowns in almost all countries meant a total shutdown of industrial and commercial activity. Thus, the first half of the year 2020 saw a sharp reduction in power demand, which in turn led to a huge decline in thermal power generation. On the other hand, the share of renewable energy especially wind and solar continues to rise as economies strive for green recovery from the covid-19 crisis. Ember’s “Global half-year electricity analysis” report shows evidence that wind and solar have quickly increased to become a major source of electricity in most countries in the world and are successfully reducing coal generation throughout the world. This analysis aggregates national electricity generation for 48 countries making up 83% of global electricity production. Following is an extract from this report.

The rise of wind and solar

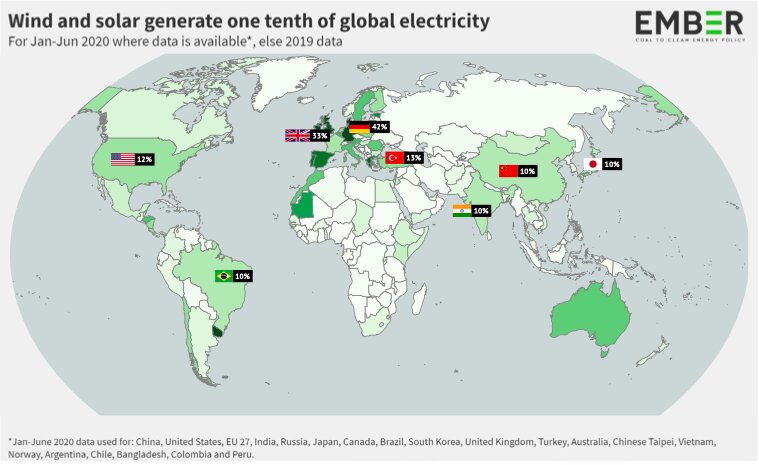

Wind and solar generation rose 14% in the first half of 2020 (H1-2020), compared to the first half of 2019. In the 48 countries analysed, wind and solar generation rose from 992 TWh to 1,129 TWh. Solar generation rose by 19% and wind generation rose by 11%. Although solar generation is catching up with wind generation, wind generation was still twice the level of solar generation in the countries analysed. Wind and solar generated almost a tenth (9.8%) of global electricity in H1-2020. Global wind and solar generation was at 9.8% in the first half of 2020, up from 8.1% in 2019. That means wind and solar generated almost as much CO2-free power as nuclear power plants, which generated 10.5% of global electricity in H1-2020.

Major countries across the world all had a similar level of wind and solar generation, in line with the global average: China 9.8%, the US 12.0%, India 9.7%, Japan 9.6%, Brazil 10.4% and Turkey 12.6%. The European Union was substantially higher, with 21.4%, the UK was at 33.2%, and Australia was also above-average. Within the EU, Germany rose to 42%. Russia (0.2%) is the largest country to so far shun wind and solar. Canada and South Korea stood out as having low levels of wind and solar share, at 5.3% and 4.0% respectively in H1- 2020.

Wind and solar have doubled their share of global electricity generation since the Paris Climate Agreement was signed in 2015. They rose five percentage points, from 4.6% to 9.8%. Most large countries more than doubled their market share from 2015 to H1-2020: coincidentally China, Japan and Brazil all increased from 4% to 10%; the US from 6% to 12%. India’s almost trebled from 3.4% in 2015 to 9.7% in H1-2020. But other countries are lagging behind the global average: Canada’s share has barely changed since 2015. South Korea’s share has been increasing, but at 4.0% is still less than half the global average, and Vietnam is making up for lost time increasing from 0.2% in 2018 to 6.4% in the first half of 2020.

Wind and solar continue to replace coal

Wind and solar have captured five percentage points in market share from coal. Coal’s share of global generation has fallen from 37.9% in 2015 to 33.0% in the first half of 2020. That fall of five percentage points has effectively been replaced by wind and solar, whose share rose from 4.6% to 9.8% in the first half of 2020. That’s a trend that happened across the world. For example, China’s coal share has fallen by 7 percentage points as wind and solar increased by 6 percentage points. Most remarkable is perhaps India, where wind and solar’s market share has risen from 3% of its total generation in 2015 to 10% in the first half of 2020; at the same time, coal’s share fell from 77% to 68%. Even in Vietnam, where coal has risen, wind and solar have risen six percentage points in just two years, thus reducing the pace of coal growth, and further weakening the case to build new coal power plants.

There are nuances, of course. In China, rapidly rising electricity demand means that although coal’s share has fallen from 68% in 2015 to 62% in the first half of 2020, its absolute level of generation actually rose by 17% from 2015 to 2019. The US has replaced coal with gas more than with wind and solar: as coal’s market share reduced by 17%, the share of gas increased 9% from 33% to 42% from 2015 to H1-2020, and wind and solar increased 6% from 6% to 12%.

The COVID-19 impact and coal’s fall

The disruption caused by COVID-19 severely impacted electricity demand, pushing down global electricity demand by around 3.0%. It was also particularly mild in the winter months of 2020 in many parts of the northern hemisphere, contributing to lower electricity demand. In H1-2020, demand was down in most countries – for example, 7% in the EU and 8% in India; the US fell only 4% as the COVID-19 impact was smaller, and China fell only about 1% due to large electricity demand growth in Q2-2020. The IEA has analysis on the falls by country throughout 2020 so far.

For the first time, coal plants were needed for less than half the time. Coal generation has fallen by 9%, but coal capacity fell only 0.1%. That means utilisation of coal plants has fallen to 47% in the first half of 2020, from 51% utilisation in 2019. That’s the first time that coal plant utilisation has fallen below 50% over six months. The fall in coal capacity in the first half of 2020 was the first time net global coal power plant capacity has fallen over six months. Global Energy Monitor (GEM) research showed that net coal capacity fell by 0.1% – by 2 gigawatts, against a total of 2047 gigawatts of operational coal plants. GEM showed that coal capacity rose in China, but fell in the rest of the world, meaning that China for the first time is home to over 50% of the world’s coal capacity. India coal plant utilisation fell as low as 42% in April and May, averaging 51% so far this year. With lower-than-expected demand for electricity, and wind and solar eating into coal’s market share, there is an increasing surplus of coal capacity.

The drop in electricity demand due to COVID-19 barely impacted wind and solar generation in the first half of 2020. That’s because wind and solar generation is lagged compared to when wind and solar are actually built; most of the rise in the first half of this year came from new wind and solar built last year. However, COVID-19 has impacted the rate of new wind and solar installed in 2020; a forecast by the IEA shows it will fall 13% in 2020 to its lowest level since 2015. Stimulus packages focusing on a clean transition can help that bounce back, but if stimulus is not forthcoming, wind and solar will struggle to achieve the levels of growth required this decade to limit warming to 1.5 degrees.

Outlook

IRENA data shows that the amount of wind and solar capacity installed in 2019 rose only 7%, and in 2018 rose only 5%. And the IEA estimates that renewable capacity growth in 2020 will fall by 13% due to the impact of COVID-19, compared to 2019. The year-on-year additions are helping to reshape the global electricity mix, but the rate of wind and solar deployed every year is not rapidly accelerating.

Unfortunately, this change isn’t enough to limit global temperature rises to 1.5 degrees. The IPCC published scenarios on how to limit global temperature rises to 1.5 degrees above pre-industrial levels. Carbon Brief’s analysis of the IPCC scenarios shows unabated coal use needs to fall by about 79% by 2030 from 2019 – a fall of 13% every year throughout the 2020s.

Climate Analytics analysis is consistent, showing that coal needs to fall to just 6% share of global electricity generation; it was 33% in H1-2020. All 1.5-degree compatible IPCC scenarios show most of coal’s fall needs to be replaced with wind and solar generation. The median of the scenarios show wind and solar reaching a 28% share by 2030.

Summing up, it’s clear that even with the rapid trajectory from coal to wind and solar over the last five years, progress is so far insufficient to limit coal generation in line with 1.5 degree scenarios.

The complete report can be accessed here.