An edited extract from EY’s report, ‘A Green Covid-19 Recovery and Resilience Plan for Europe’, which was funded by the European Climate Foundation. Utility federation Eurelectric and European wind, solar and hydrogen industry groups provided input for the study.

A recent report by EY titled ‘A Green Covid-19 Recovery and Resilience Plan for Europe’ states that more than 1,000 ‘shovel-ready’ green projects that require some Euro 200 billion in public and private investments could immediately create social, environmental and economic value as part of a recovery from the economic slump caused by the Covid-19 pandemic. The investment would also support 2.8 million jobs.

It is worth mentioning that renewable energy generation projects (36 per cent), transmission and distribution (7 per cent), energy storage and system services (4 per cent), green hydrogen (5 per cent) jointly make up more than half of all projects identified by EY in the report. To state some examples, Italy’s Enel Group features prominently on the list, with a Euro 400 million project for a PV ‘3SUN’ module gigafactory in is home market that would expand the utility’s 200 MW per annum panel production capacity in Sicily to more than 3 GW annually, using hetero junction technology. Enel’s Spanish Endesa unit is also mentioned, with a Euro 1.4 billion project in Teruel to substitute and convert a coal-fired power plant with 1.59 GW of solar and 140 MW of wind plants, as well as a 160 MW battery storage system.

The list of 1,000 projects also includes the HYBRIT project in northern Sweden by Vattenfall, SSAB, and LKAB to produce fossil free steel, a Euro 1 billion plan by LG CHEM for an electric vehicle battery gigafactory in Poland, a Euro 98 million project for a green hydrogen plant (H2V) at the Port- Jérôme in France, and a Euro 553 million offshore wind project in Estonia by Tuuletraal.

Sector Analysis – Energy

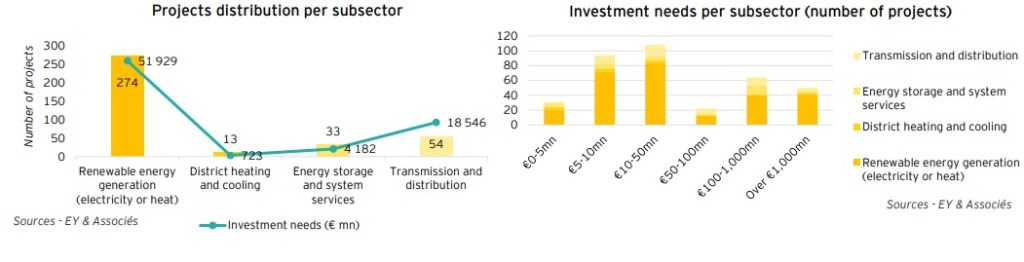

Of the total 1,000 projects, the overall number of projects in the energy sector is 374, in areas such as renewable energy generation, energy storage, transmission and distribution as well as district heating and cooling. The aggregated investment required amounts to Euro 75 billion (for identified projects). The average size of projects (Euro 202 million of investment) covers a great diversity of projects, varying from small, decentralized projects to large scale infrastructure projects (renewable energy generation or electricity transmission projects).

Seven countries concentrate over 50 per cent of all projects selected: France (13 per cent), Spain (8 per cent), Germany (8 per cent), Italy (7 per cent), Romania (6 per cent), the Netherlands (6 per cent) and Poland (5 per cent). The distribution by investment needs shows however a different breakdown due to large grid infrastructure projects located in Hungary and Netherlands. Not all projects under development are captured, due the time constraints of this study or to confidentiality concerns.

In terms of project categories, 73 per cent of projects submitted and 69 per cent of investment needed relate to renewable energy generation. These projects can be split into three groups of similar number of projects depending on the size of the investment required – a third of up to Euro 10 million, another third between Euro 10 million and Euro 100 million and the last third requiring Euro 100 million and above.

The project category that comes second in number of projects are transmission and distribution (14 per cent of projects selected) followed by energy storage and system services (. The average size of transmission projects is substantially higher, as a number of grid extension projects are large infrastructure projects. Taken together, the 54 transmission projects represent over €18 billion of investment, about a quarter of the total for the energy sector. Other categories such as district cooling and heating represent smaller shares of project numbers and investment requirements. It is to be noted that the selection includes several projects of large-scale manufacturing of advanced solar PV modules (in Germany, Italy, France) and of batteries (in Poland and Sweden), and of electrolysers (in Spain).

Many respondents to EY’s survey and interview requests expressed the will to build and invest in projects that deliver environmental value. They encourage the EU leaders to continue to develop new initiatives to support such projects and initiative and to stay in leading role worldwide. However, there are several challenges in deployment of energy projects, as identified by these developers.

- Accelerating the development of renewable energy projects will require to overcome barriers related to grid connection timeline and to insufficient power transmission capacity. Infrastructure expansions are needed in order to take into account the EU’s climate target. For example, the transmission network has been saturated in Spain with strong capacity additions (4 GW) over a single year, while in the Netherlands the saturation of the distribution network prevents new additions of rooftop solar.

- Current challenges in Europe include the fact that in many countries the permitting process is long and complex and is increasingly becoming a bottleneck.

- Tax exemptions or subsidies for conventional fuels limit the penetration of more recent green energy technologies.

- Several project developers consider that the post-Covid situation may create more restrictive and constraining financing terms from debt lenders, which would as a consequence impact the financial feasibility of their projects. Some corporations have also indicated the need to focus on margin protection in the next months and will postpone or cancel investments, for example in the manufacturing of low carbon technologies.

EY has accordingly provided the following recommendations to over come the challenges:

Transmission and distribution networks: Prioritize public investments in the extension of power transmission and distribution networks, with the support of the CEF and TEN-E initiatives, in line with the EU’s long-term climate neutrality objective

Permitting process: Facilitate administrative procedures and set clear and enforceable deadlines; support capacity-building for local/national authorities in charge of permitting processes; simplify and shorten permitting procedures where possible, so as to maintain high-quality projects which respect environmental considerations, while ensuring a fast, cost efficient and long-term focused process

Market framework conditions: Provide better visibility on auctions, indicating the volume of MW expected per year and per country will provide clarity for project developers and equipment manufacturers. Similarly, deploying European-wide procurement schemes (via auctions or corporate PPAs) will contribute to improving the visibility on market deployment; Renewable energy supply chains should be considered as strategic sectors, given the strong competition from third countries. Other measures to support industrial relocation in EU countries should be developed; Contract-for-Difference schemes have proven useful and should be deployed widely in the EU; support capacity building at the municipal level to enhance the emergence of projects, and support the deployment of corporate Power Purchase Agreements (PPAs) with a dedicated guarantee scheme, as the economic downturn will affect commercial and industrial, a counterparty risk guarantee will be needed to support corporate PPAs.